Society of Manufacturers of Electric Vehicles (SMEV), an industry body representing the Indian electric vehicle industry, releases its yearly report summarizing the performance of the EV market fiscal year 2022-23 (Apr-Mar). The industry registered sales of 1152021 Electric Vehicles, which include E-Buses, E-Cars, E-Three-wheelers, and E-two-wheelers in FY 2023.

As per the data sourced from manufacturers, 120,000 low-speed (LS) E-scooters, 285,443 (LS) E rickshaws, and around 50,000 (LS) E-cycles were also sold in FY23,

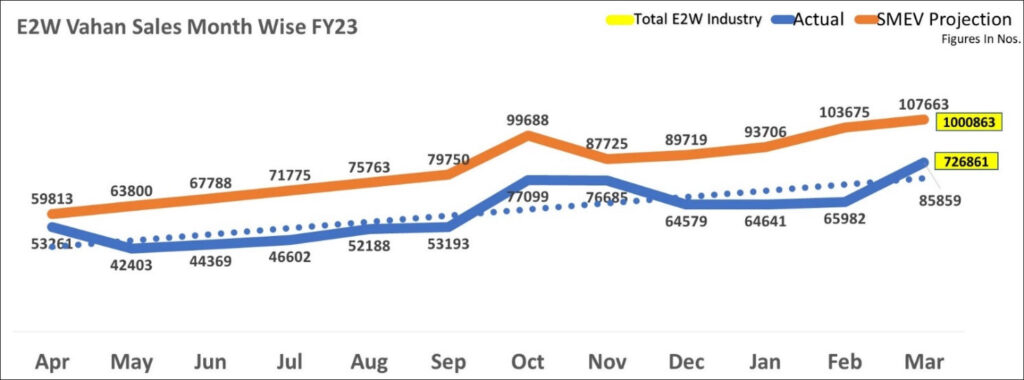

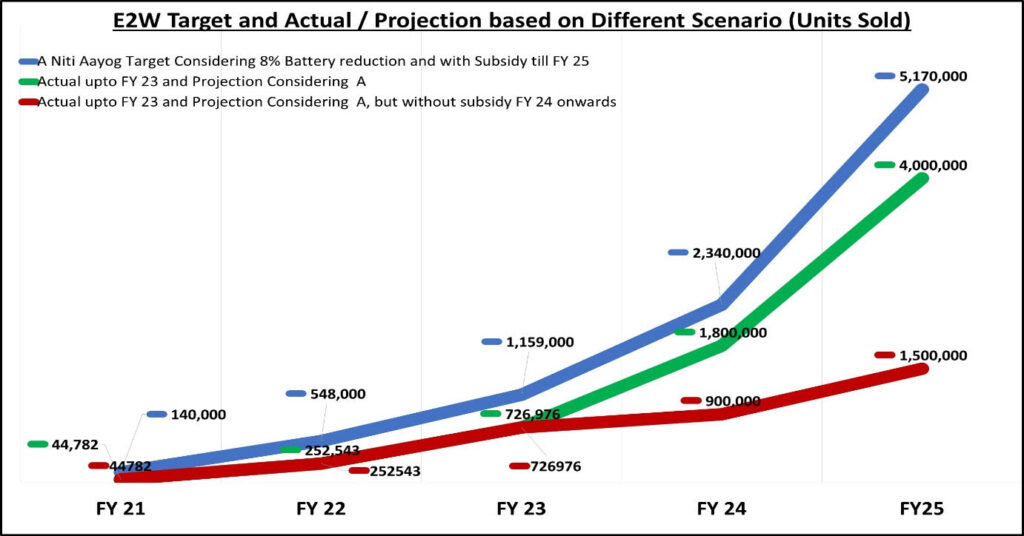

In the electric two-wheeler segment, the industry sold 7,26,976 high-speed E2W (speed>25km/hr) in FY 2023. However, the E2W adoption fell month on month over the targets ending with an annual shortfall of more than 25% over the minimum target set by Niti Aayog and various research organizations.

While the market has been making good progress in recent years towards a sustainable and greener future, industry experts and stakeholders are concerned that the momentum in E2W adoption fell after the Indian festive season. Ironically it was not the consumer demand but the sudden withholding of more than the Rs.1200 crore subsidy already passed on by the majority of OEMs to the customers on the pretext of delay in the localisation. Another Rs.400 cr of the OEMs operating in the premium end also got stuck due to the allegation of under invoicing to bypass the FAME norms leading to crippling of their business operations due to extreme shortage of working capital. Today 16 companies that represent more than 95% of the industry are waiting for some resolution for the chaos and the fiasco of the FAME PMP are cleared to enable them to plan their businesses in the year FY24

Commenting on the performance of the E2W industry, Sohinder Gill, DG SMEV, said, “Over the years, the E2W industry has been catching pace and working relentlessly towards achieving the country’s mission of largely converting to electric. While all the earlier schemes since 2015 had negligible effect on the EV adoption, the revised FAME2 in late 202 had a dramatic effect on E2W adoption as it decreased their prices by around 35%. This started attracting the component supply chain that had earlier shunned anything to do with E2WS because of extremely low volumes and it is only in the late 2021, suppliers started queuing up to OEMS to show their eagerness of developing EV component. It took most of these suppliers 12 to 18 months, the usual time that it takes to localise and now most of them have started setting up sufficient capacities.

Meanwhile some persons with malicious intent unleashed a campaign to put an immediate stop to this dream run for the reasons best known to them. These persons must be rejoicing the complete derailment of the EV mission of India by forcing the policy makers to take a “black or white” position on the policy rather than a pragmatic approach of flexibility in the implementation due to factors beyond the control of the OEMs. With only 5% adoption in FY23 and the short term goal of 30% and the EV mission of 80% adoption by 2030 looks more like a mirage. All is not lost and what perhaps can put the industry back on track is an extension of the PMP eligibility criteria by 2 years and strictly enforcing it from April 23.

Some of the key factors that are important to look at in order to immediately strengthen the EV ecosystem are as follows:

Supply Chain

The absence of enough local manufacturing capacity for vital components like batteries and motors is one of the major problems in the supply chain. Due to supply chain interruptions during COVID, the industry suffered greatly to find high-quality components. To develop a sustainable and effective supply chain, numerous ecosystem stakeholders have played a significant role. SMEV is pleased to report that the sector has reduced its dependency on imports and is now self-sufficient, with the majority of the components being produced domestically.”

FAME Scheme

The government’s decision on the continuation of FAME is a critical piece that will decide the fate of the entire industry and the market is eagerly waiting for clarity. The confusion among players is making it difficult for them to develop a long-term strategy. Any abrupt reduction in subsidies will have a significant influence on the growth trajectory and could jeopardize the government’s plan for e-mobility. It will have a negative effect and could completely eliminate a sizable portion of the market. In order to encourage the development of the EV ecosystem and make it self-sustaining, it is crucial to have an extension of the FAME scheme for at least 3–4 years.

SMEV acknowledges that subsidies can’t be a sustainable solution in the long run therefore, it recommends phased tapering-off of subsidies after reaching a certain threshold. For example, the government can limit the subsidy after converting 25% of two-wheelers into electric ones. Understanding the pressure on the exchequer due to several schemes run by the government, SMEV strongly advocates the ‘polluter pays’ principle, where a cess is levied on the sale of each ICE vehicle to create a fund for supporting green vehicles thereby reducing the burden.

Subsidy Mechanism

Currently, the manufacturers pass the subsidy to the customer and claim it from the government post the sale. The current method lacks transparency, which may lead to OEMs manipulating sales to claim the subsidy fraudulently. SMEV recommends the introduction of a direct subsidy mechanism that allows incentives to be directly paid to the customer by the Government thus, avoiding any discrepancy.

PLI scheme

SMEV welcomes the amendment made to the PLI scheme for Automobiles and components, which previously restricted MSMEs and startups from participating in the scheme. It will create a level playing field for pure-play EV companies and allow them to compete with other players.