The webinar organised by Guidance Tamil Nadu and YES BANK deliberated on the potentials and challenges that lie ahead of the Indian EV industry in developing a holistic manufacturing ecosystem to propel future growth and investments in electric vehicles.

With gradual emergence of electric vehicles in India in recent times, the domestic EV industry is keenly shifting its gears in terms of localisation of key components and aggregates to enhance local assembly of EVs. There is a greater necessity for the industry to bring economies of scale to aid rapid adoption of EVs in the country, especially among mass market buyers, to reap the benefits of zero-emission and sustainable mobility in the country.

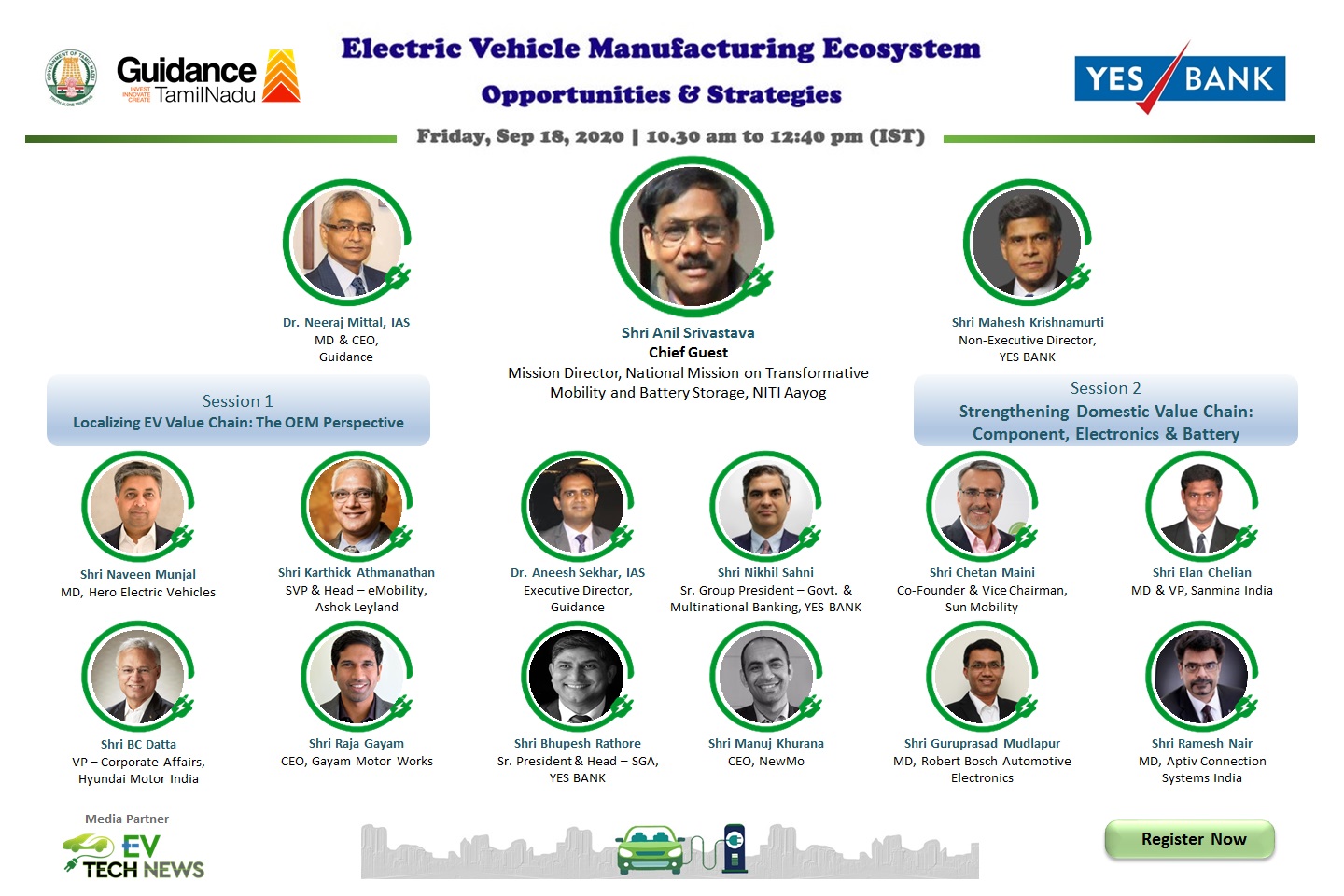

In this regard, Guidance Tamil Nadu, in association with YES BANK, organised a live webinar on ‘Electric Vehicles Manufacturing Ecosystem – Opportunities and Strategies’ on September 18 to deliberate on the potentials and challenges that lie ahead of the industry in developing a holistic manufacturing ecosystem in the country to propel future growth and investments in electric vehicles. The webinar saw industry folks from OEMs, components and battery, charging infrastructure, and technology providers discussing on the post-COVID scenario, new business models, challenges and localisation strategies in strengthening the local EV value chain, and develop domestic capabilities in manufacturing of electric vehicles.

In their opening remarks, Nikhil Sahni and Mahesh Krishnamurti of YES Bank reflected the favourable perception and prospects prevailing in the domestic auto industry with regard to EVs, while noting that maximum localisation of key aggregates and export capabilities can elevate India into a global player. Neeraj Mittal IAS, MD and CEO of Guidance Tamil Nadu – the investment promotion agency of the state of Tamil Nadu – claimed that the Indian EV industry is at the cusp of a major shift with regard to manufacturing. Noting that the investments on EV manufacturing and related-tech start-ups are surging in the country over the last couple of years, he drew attention to the Tamil Nadu’s pro-active EV policy in fostering a vibrant manufacturing ecosystem, following the footsteps of the already established automotive and component manufacturing base in the state.

Mittal IAS also emphasised on the comprehensiveness of TN’s EV policy that aims to patronage EV industry in its entirety, with wide set of subsidy and support mechanisms across demand and supply sides of manufacturing, charging infrastructure, battery development and recycling, and so on, including the country’s first EV park coming up in the state. Acknowledging the robust auto manufacturing base in the state, Anil Srivastava IAS, Director – National mission on transformative mobility and battery storage, Niti Aayog, said that with right strategies facilitating manufacturing and skill development, TN can lead the EV movement in the country. “I urged the industry to have necessary confidence to lead EV manufacturing with ‘out of the box’ thinking and high localisation of the supply chain” he said, while adding that much of the technologies except cell manufacturing are locally available in India.

In a focussed panel discussion on “Localizing EV value chain – The OEM perspective”, BC Dutta (VP-Corporate affairs) of Hyundai Motor India – the largest investor in Tamil Nadu with regard to EVs – stressed on the joint development as an important and only strategy in localisation of EV supply chain at present. While Naveen Munjal (MD) of Hero Electric opined that demand for EVs can be a strong driver in pushing the domestic industry into localisation, Karthick Athmanathan, SVP and Head – e-mobility at Ashok Leyland, stressed on the need for the local ecosystem to adopt dynamic collaborations and innovative business models. Athmanathan also underscored the need for focussed subsidy strategies for commercial vehicles, as their market dynamics are different from that of private vehicles.

Speaking on post-COVID market scenario for EVs in the country, Chetan Maini (Co-founder and vice-chairman) of Sun Mobility identified three broad segments emerging as growth drivers, led by vehicles for delivery applications, personal mobility, and shared-personal mobility. “Localisation to 100 percent in certain components including that of chassis, motors and controllers, and charging systems is possible at present and can even be realised in the short term”. On battery manufacturing, he said that cell assembly is already happening, but cell manufacturing using Lithium requires long-term and strategic partnerships, but the cost of cells is just around 7 percent of total cost from a vehicle manufacturing point of view. “That means, we have have more than 90 percent of cost factors that can be localised even before cell manufacturing”, he averred.

Maini was part of the second panel titled “Strengthening domestic value chain – Components, Electronics and Battery”. The speakers of this panel shared their consensus on the need for a strong policy that is technology agnostic and offers a level-playing field (with regard to taxation) based on services and contribution to the EV value chain. They also called for commonality of EV technologies and platforms to strengthen and streamline the domestic value chain in the country.