Asset-light model for STUs, healthy returns on projects for bus operators to aid adoption

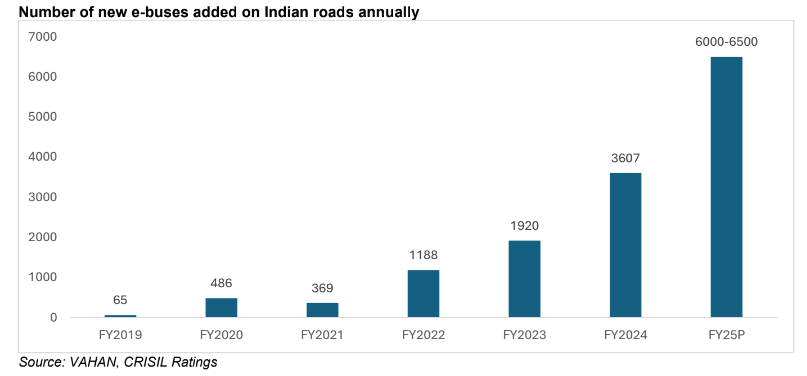

The supply of electric buses (e-buses) in India will surge 75-80% on-year, albeit on a small base, to 6,000-6,500 this fiscal (see chart in annexure), spurred by increasing deployment via tenders awarded under various schemes for procurement by state transport undertakings (STUs) through the gross cost contract (GCC) model.

These schemes include Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles (FAME) (1 and 2), National Electric Bus Programme (NEBP) under Convergence Energy Service Ltd (CESL) (1 and 2), and PM-eBus Sewa Scheme. Tenders awarded under these schemes had propelled orders for e-buses to 24,0001 at the beginning of this fiscal.

Efforts by the central government to reduce carbon emissions in public transport are driving e-bus adoption. This, along with favourable contracting terms under the GCC model, which has emerged as the preferred route for e-bus purchase by STUs, has supported deployment.

Says Gautam Shahi, Director, CRISIL Ratings “E-bus adoption is truly in a sweet spot because the interests of STUs and bus operators are being taken care of under the GCC model, with optimal distribution of risk among stakeholders. For example, GCC is an asset-light model for STUs with no upfront cost of acquisition as e-buses are financed by bus operators. Bus operators, in turn, don’t carry any passenger traffic risk and get a steady income stream because of assured rentals per km with tariff revisions linked to inflation. Consequently, they generate a healthy internal rate of return of 10-11%2 over the tenure of the concession.”

That said, counterparty risk remains a key variable for operators when bidding for e-bus tenders as STUs with weak credit profiles have resulted in stretched debtor cycles in the past.

To manage this risk, the government has announced a payment security mechanism (PSM) under the PM-eBus Sewa Scheme in August 2023. The government is working on the modalities of setting up a dedicated payment security fund (PSF)3 to secure the receivables of bus operators in case there is a delay in, or failure to make, payment by STUs within the prescribed time as per the concession agreement.

Additionally, for the recently awarded tenders under the PM-eBus Seva Scheme, there is a provision that allows bidders to execute the concession agreement only after the PSM has been notified.

While the surge in e-bus orders will generate economies of scale in production, declining battery costs will lower the purchase price of an e-bus. The benefits of the potential decline in e-bus prices may be passed on to STUs by bus operators, in terms of rentals per km, thus further aiding adoption.

Says Pallavi Singh, Associate Director, CRISIL Ratings, “Existing strong e-bus orderbook, along with the remaining orders of 7800 buses to be awarded under the PM e-Bus Sewa Scheme4 will give a fillip to the sector. Moreover, the government is expected to further augment this scheme, which, will continue to support growth of e-bus sales over this and next fiscal.”

1 Aggregate order book of seven key OEMs: PMI Electro Mobility Solutions Pvt Ltd, Olectra Greentech Ltd, JBM Auto Ltd, Tata Motors Ltd, Switch Mobility Automotive Ltd, VE Commercial Vehicles Ltd and EKA Mobility. Orderbook increased from 17,370 e-buses as on Mar-24.

2 Calculated basis a 12-meter bus running for 12-year tenure without government subsidy assuming revenues of operators in line with the concession agreement and operators’ related operational expenses — annual maintenance, manpower, power and charger, depot, and others — to arrive at operational cashflows.

3 In case of delay in payment by STU to bus operators, money will be transferred from the PSF to an escrow account of the bus operator. The PSF has to be replenished by the STU within 90 days and if it fails to do so, the Reserve Bank of India will debit the state government current account under a predefined mechanism and transfer the amount to the PSF.

4 The scheme aims to deploy 10,000 e-buses in 169 cities, of which, ~2,200 buses have already been awarded and form part of the existing e-bus order book of 24,000