By Kinjal Shah, Vice President & Co-Group Head – Corporate Ratings, ICRA Limited

The automotive industry, both in India and overseas, is experiencing rapid technological evolution, and electrification trends are gaining prominence across sectors. With commercial vehicles (CV) being significant contributors to vehicular pollution, governments are keen to accelerate electrification in the segment to achieve carbon neutrality goals. However, ICRA expects the adoption of electric vehicles (EVs) within the CV sector to be mixed, with fast-paced adoption likely in some sub-segments such as passenger carriers/buses and light commercial vehicles (LCVs), while the medium and heavy commercial vehicles (M&HCV trucks) are expected to lag behind.

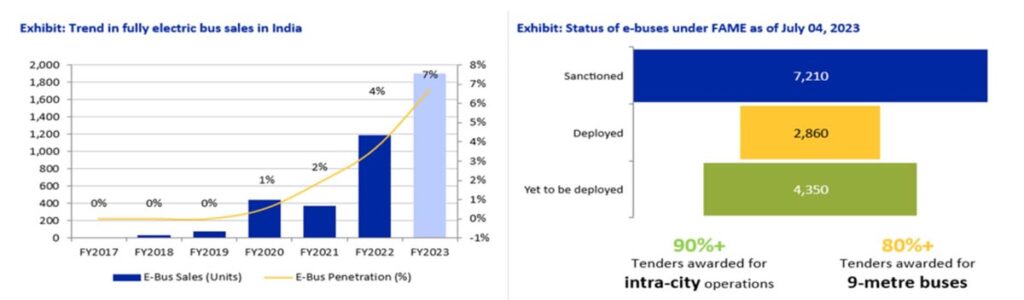

Electric buses (e-buses) are expected to lead India’s electrification drive, as the segment has witnessed healthy traction recently and is likely to continue growing. As of FY2023, e-buses accounted for 7% of total bus sales in India, and ICRA expects this to increase to 11-13% by FY2025 and 40% by FY2030, with the highest adoption expected for intra-city operations. While limited charging infrastructure, range anxiety, and high capital costs have been key deterrents for electrification across segments, these challenges are relatively lower for the bus segment.

Similar to other geographies like China, India has also announced significant incentives and subsidies to promote e-bus adoption through schemes like Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) and Smart Cities. Many state EV policies have also set specific electrification targets and timelines for buses, creating a roadmap for electrification.

The FAME II scheme implemented by the Department of Heavy Industries (DHI) planned a significant outlay of Rs. 35 billion to support e-bus adoption in India. Under the scheme, 7-metre, 9-metre, and 12-metre electric buses are eligible for a capital subsidy of Rs. 35 lakh, Rs. 45 lakh, and Rs. 55 lakh, respectively, subject to meeting technical specifications and localisation requirements. Although the on-ground deployment under the FAME scheme faced some delays due to pandemic-induced challenges, it was extended by two years to April 2024, and steady progress has been made over the past year towards meeting FAME II targets. ICRA estimates that ~2,860 e-buses have been deployed out of the sanctioned 7,200 e-buses under FAME II, while the rest are in the process of being bid out or delivered.

The Gross Cost Contract (GCC) model, or opex model of operations, has emerged as the preferred route for e-bus adoption in India, particularly because the FAME II scheme offers capital subsidies only for buses procured under this route. This model significantly alleviates the upfront capital burden on cash-strapped State Road Transport Undertakings (SRTUs), while promoting electrification through increased private participation in the segment. However, the model is currently evolving, and operators are exploring various measures, such as payment security mechanisms, to mitigate the risks prevalent in the model. According to ICRA, while execution-related risks remain relatively lower for these projects, operational risks are somewhat higher, given the lack of an adequate track record of EVs in the country. Operators with direct backing from e-bus OEMs, along with sufficient financial wherewithal and flexibility, would be better placed to establish a strong foothold in this segment.

Although the Niti Aayog has outlined a Model Concession Agreement for electric bus projects under the GCC model, taking into account the interests of various stakeholders, it remains to be seen how various risks related to project execution, bus performance, receivables, etc., play out over the medium-to-long term. Nevertheless, as the model matures, electric buses are expected to witness increased adoption, aided by favorable cost economics.

Bus costs are the single largest cost element in electric bus projects, accounting for 75-80% of the project costs. With the capital subsidy of Rs. 35-55 lakh per bus under the FAME II scheme, the capital subsidy element can fund a large part of the project costs, up to even 40%, which bodes well for the viability of these projects. Additionally, along with the significant savings on fuel costs (3-5x cheaper vis-à-vis conventional buses), these subsidies help lower the total cost of ownership (TCO) of e-buses by 10-25% compared to diesel or CNG buses. While the FAME II scheme and associated subsidies are supporting the initial penetration, it is expected that capital costs would reduce with localization and evolution in battery technology, which, coupled with favorable operating economics, would support sales subsequently.

Among the other CV sub-segments, while the current penetration levels are negligible for LCVs, they are expected to witness relatively faster electrification trends going forward, supported by their favorable operating economics. CV OEMs are already introducing electric variants of their LCV workhorses, and adoption is gradually gaining pace. This is fueled in large part by favorable operating economics and initiatives by numerous companies, notably e-commerce firms, employing green vehicles for last-mile transportation needs. The trend is expected to further gain pace in the future, achieving a penetration of 4-6% by FY2025 and ~25% by FY2030.

In M&HCV trucks, electrification is unlikely to gain meaningful penetration in the near-to-medium term, considering their longer-range requirements and lack of adequate charging infrastructure. Moreover, OEMs are exploring various options for migration to cleaner technologies in the M&HCV segment, including hydrogen engines, hydrogen fuel cells, ethanol-based fuels, etc., in addition to electric vehicles. Accordingly, OEMs are focused on developing the right products for the market across technologies, and it is likely that several powertrain options will co-exist in this segment over the medium term.

ICRA notes that while demand for EVs is increasing, financing options continue to be an impediment in the overall electric CV sales, with many large banks and NBFCs not yet lending to this segment, limiting buyers’ financing alternatives. Additionally, with the track record of the technology and that of several OEMs yet to be established in the domestic market, coupled with concerns over battery life and residual value, financing options are inherently more expensive due to perceived higher risks.

Notwithstanding these challenges, the outlook for electrification in the CV industry, especially in buses and LCV trucks, remains favorable in the medium-to-long term due to growing demand for EVs, environmental concerns, and higher CNG and diesel prices. Besides, several cities are increasingly limiting the registration, admission, and usage of polluting vehicles, and as a result, EVs are expected to gain further popularity. Additionally, lower TCO, as well as the government’s push for net-zero targets and support in the form of government incentives, are expected to boost their sales in the medium-to-long term. With incentives under the FAME-II scheme set to expire in less than a year, there is a likelihood of sales pace gaining further momentum in the current fiscal. However, geopolitical developments, including their impact on battery pricing and availability, as well as the financing environment, remain key monitorables for the electrification trends in the domestic commercial vehicle segment.