By Venkata Narasimha Rao Jupudi, a CV industry veteran with over 30 years of experience

Transportation is a fundamental human need that has evolved significantly over time, starting from the invention of the wheel to the current use of alternative energy sources like electricity and fuel. Despite advancements, the methods of carrying energy sources in vehicles have remained relatively unchanged, with the majority of buses relying on overhead traction. This paper aims to provide a brief overview of the technological changes in the transportation industry over the years and discuss potential future trends.

Evolution of CVs in India

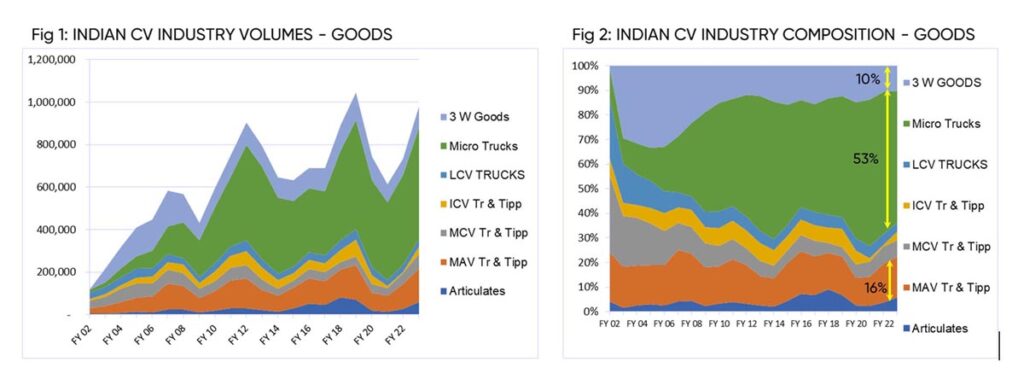

The Society of Indian Automobile Manufacturers (SIAM) has classified the commercial vehicle (CV) industry in India based on vehicle Gross Vehicle Weight (GVW). Initially, until the mid-1980s, the industry had a single segment of 16-ton vehicles serving both goods and passenger transportation. However, with time, new vehicle segments emerged, leading to a shift between these segments. The Total Industry Volume (TIV) has seen substantial growth, from a modest 116,000 units in FY 2001-02 to a staggering 981,000 units by FY 2022-23 (see fig. 1).

Micro trucks, which began as pickup vans in the early 1990s, now constitute 53% of the annual CV sales (see fig. 2). The launch of TATA ACE has significantly boosted this segment, eating into the market share of three-wheelers (3W), especially in the goods segment, which now holds only a 10% share. Similarly, the launch of Light Commercial Vehicles (LCVs) and Intermediate Commercial Vehicles (ICVs) has impacted the Medium Commercial Vehicle (MCV) segment.

Market trends show that Medium and Heavy Duty (MAV) trucks have gained popularity by penetrating the bottom portion of Articulated vehicles (Tractor Trailers) and the upper portion of the MCV/ICV truck segment. This shift is a result of the evolving hub-and-spoke model of goods distribution, wherein large volume vehicles are used for long-distance transportation, while micro trucks and LCVs handle the first mile and last mile of the supply chain. A closer look at the M&HCV segment reveals the dominance of MAV trucks (see fig. 3).

Passenger transportation exhibits a similar trend (see fig. 4 & 5), where three-wheelers dominate the segment. Without three-wheelers, LCV buses take the lead in the passenger segment.

Impact on Engine Technology

The evolution of commercial vehicles has driven the need for higher-powered engines and efficient powertrains to sustain long-haul operations and also low-powered engines for short-haul purposes. As a result, the lower end of the segment has become price-sensitive, while the higher end has become performance-sensitive. Key drivers for higher segments are durability and reliability, whereas lower segments prioritize low prices and ease of serviceability. Various factors influence segmental analysis, and they continue to change over time. Automotive technology is continuously improving to address these drivers and contribute to volume growth (see fig. 6). Moreover, these advancements in technology extend beyond the drive train and vehicle optimization.

Challenges and Opportunities

We see changes happening in the following areas:

1) Alternative fuels, hybrids and cleaner fuel

2) Drive for e-mobility

3) Improvise customer experience in vehicles.

4) Self-driving vehicles in short haul & repetitive operations like mining or port applications

5) Connectivity and data Integration of vehicle monitoring and tracking systems leading to Predictive maintenance.

6) Innovative vehicle buying experience

These changes in vehicle technology and evolution would inevitably lead to increased product costs. However, due to stiff competition, OEMs (Original Equipment Manufacturers) face margin pressures and cannot entirely pass these costs on to the customers. To address this challenge, various avenues can be explored, such as reducing Material, Unnecessary Work, Downtime, and defects (MUDA) through leaner production, accelerating automation, and creating connected data-led services. Embracing these opportunities will enable OEMs to capitalize on end-to-end digital innovation throughout the transport value chain, thereby creating a more progressive and productive supply ecosystem.

Conclusion

The Indian commercial vehicle industry has come a long way from its primitive days, evolving into a complex ecosystem with various vehicle segments and technological advancements. Future trends indicate the continued pursuit of efficient and powerful vehicles, accompanied by opportunities and challenges that demand innovative solutions. By embracing the changing landscape and leveraging digital technologies, the industry can forge a path towards sustainable growth and enhanced customer experiences.