OEMs will have to incur significant capex to meet the government’s Electric Vehicles (EV) Vision – goal of 30 percent penetration for EVs by 2030, which is likely to be delayed due to the current weak business environment, according to a latest report by Brickworks Analytics.

The impact of Covid-19 on businesses is unprecedented, and the severity of the lockdown and challenges faced by the domestic economy have been starkly brought out by the 23.9 percent contraction in the GDP in Q1FY 21. Among sectors, the lockdown has caused significant disruption in manufacturing sector activity, with the automobile sector, which contributes ~22 percent of the manufacturing and nearly 7 percent to the overall GDP, facing severe hardships. Recently, the sector started showing gradual recovery signs, but revival is largely attributed to pent up demand which materialised particularly during the festival season. What’s much more worrisome is that the investments have taken a backseat, that too at a time when the Indian government is increasingly supporting the adoption of Electric Vehicles (EVs) through various policy initiatives and is pushing to accelerate the same, with the vision of EVs constituting 30 percent of the overall vehicles on road in India by 2030.

To boost the adoption and manufacturing of EVs by creating EV manufacturing capacities of a global scale and competitiveness, the firm’s capex requirement is crucial at the initial stage. Apart from multiple factors such as price, charging infrastructure, mass acceptability and evolving technology, setting-up manufacturing units for EVs is a significant requirement for the EV market. In line with rising customer demand noted for EVs in FY20, many auto manufacturing companies have already increased their capital expenditure to widen the scope of proposed EV businesses; however, the current crisis situation might lead them to rethink their proposed capital expenditure.

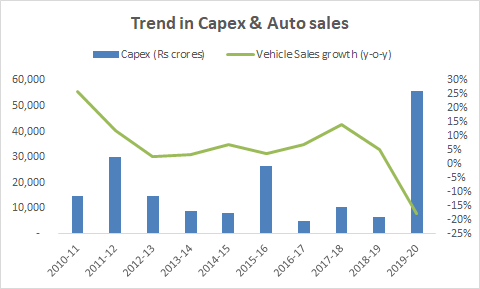

Given the expectation of a ~10 percent GDP contraction in full year FY21, demand for EVs is also likely to slow down. As the country continues its battle with the pandemic by trying to contain the spread of the virus through social distancing norms, a quick turnaround in economic activity is not expected. The government has limited resources to spend for reviving demand, and hence, the economy may take more time to return to normalcy. In such a scenario, meeting required investment levels to accommodate EV manufacturing capacities also looks challenging as the automobile sector is already grappling with huge losses given that sales were already weak before the pandemic hit and were then further exacerbated due to the lockdown.

As per Brickworks Analytics (BWA), Original Equipment Manufacturers (OEMs) will have to incur capex to the tune of ~ INR 3.5 lakh crore, exclusively for EVs, in the next 5-7 years to meet the government’s vision of EVs constituting 30 percent vehicles on road in India by 2030. This amount is significant as OEMs currently have a capex of around INR 25,000 to 30,000 crore per year in terms of enhancing their capacity for model launches and upgradation of existing models. Hence, apart from their regular capex, OEMs will have to incur additional capex to the tune of INR 30,000 crore per year on EVs’ capacity creation.

However, it seems unlikely that OEMs will be able to incur such significant capex as the business environment has been badly hit due to the pandemic. Vehicle sales were already at their decadal low when the pandemic hit, and the sector is one of the worst hit during the pandemic as well. Hence, the cash accruals of OEMs were badly impacted during FY20 and FY21, and will take more time to return to pre-Covid levels. These two years of continuous slowdown and the subsequent capex already incurred to meet the BS-VI emission norms will restrict OEMs from committing significant capex towards capacity creation for EVs and meeting the government’s vision of EVs constituting 30% of overall vehicles on road in India by 2030. However, BWA expects larger OEMs to take the inorganic growth path and acquire smaller, but specialised, players in the EV space, especially in the relatively lower value two-wheeler space.

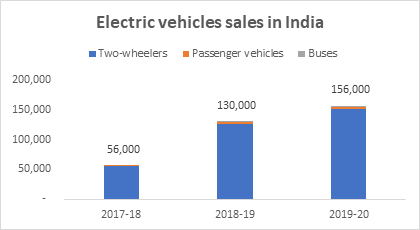

Two wheelers is the largest segment in the Indian automotive industry representing ~80 percent of Indian automotive sales. Owing to the vastness of this segment, it has a huge potential to promote emission-free mobility in the country. Two wheelers are expected to be one of the early adopters of electrification. High vehicle utilization and easy home or workplace charging would drive the uptake in the two-wheeler segment.

In addition to the policies, tax incentives and subsidies offered by the government to encourage EVs, there is a need for upfront weighted deduction on capital expenditure, which can help OEMs plough back more capital into expansion and technology upgrades. The allocation of funds (capital outlay) in Union Budget 2020-21 is negligible at INR ~700 crore; hence, much more support is expected from the government. The Union Government needs to come up with a scheme similar to the Technology Upgradation Fund Scheme (TUFS) in the textile sector, to help OEMs upgrade towards EV technology. The amended TUFS envisages interest reimbursement on the loans taken for technology upgradation and provides one-time capital investment subsidy of 10 to 15 percent on eligible machines for different segments with a subsidy cap. Such a subsidy if proposed for the automobile sector will take away some burden from the OEMs and help them achieve the EV vision.