What happens to EV growth once subsidy ends?

Penetration of electric vehicles (EVs) in India has been largely driven by subsidies, especially the Faster Adoption and Manufacturing of Hybrid and Electric Vehicle, or FAME, scheme under the National Electric Mobility Mission Plan, and subsidies offered by various states.

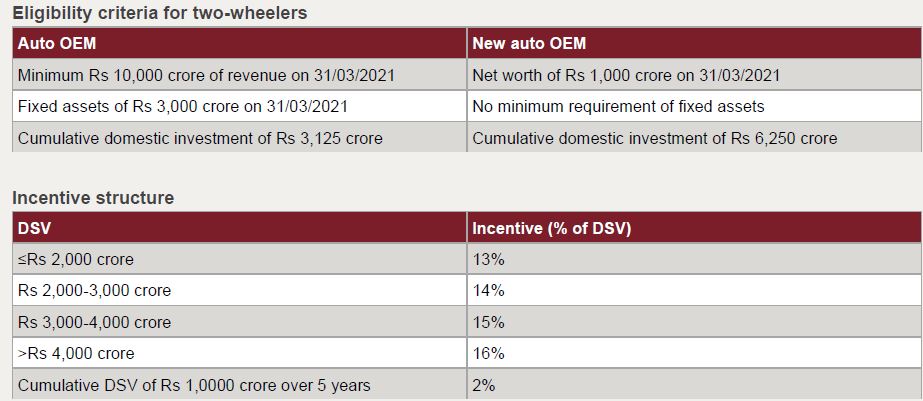

These sops have bridged the gap between the purchasing cost of a traditional, internal combustion engine (ICE) vehicle and that of an EV. From 60-65% of total outlay under FAME I, the incentives have risen to ~85% under FAME II. Once they exhaust — likely by fiscal 2024 — the Production Linked Incentive (PLI) scheme could drive EV adoption.

Over the past five fiscals, subsidies have accelerated EV sales rapidly (more than ~20% on-year growth in most segments), on a low base of fiscal 2017 and despite the pandemic. Adoption of electric two-wheelers has been strong — a trend that’s likely to continue — due to better cost economics, availability of multiple models, and feasibility of home-charging options (see chart below).

India is the second-largest two-wheeler market in the world with 20 million vehicles sold per year prior to the pandemic outbreak, and the momentum should hold in the coming years.

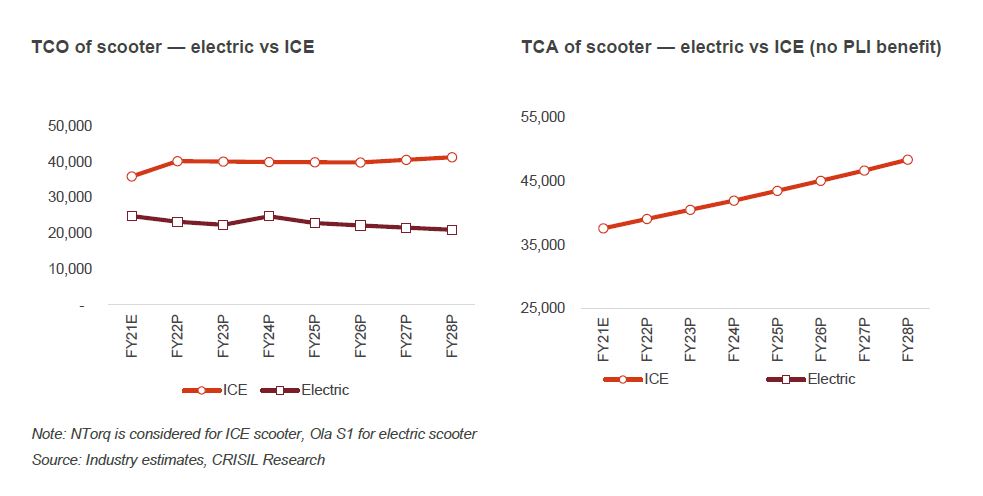

Electric two-wheelers also have better total cost of ownership (TCO) versus their ICE cousins on account of lower fuel cost and expected gradual decrease in battery prices. That is a demand-positive.

The penetration of electric two-wheelers is expected to rise from ~2% in fiscal 2021 to 10-15% by fiscal 2026 and 37-42% by fiscal 2031, with sales reaching 3-4 million units and 14-15 million units, respectively. Electric scooters are expected to comprise a majority of sales because of the availability of multiple models and lower TCO.

Owing to the FAME incentive, the total cost of acquisition (TCA) of electric scooters would be lower than that of ICE variants by Rs 7,500-9,500 in fiscal 2022 and fiscal 2023. Given that sales are expected to spike over the next few years, we expect the FAME II subsidy to get over in fiscal 2023, as against the government deadline of a year later. That means, in fiscal 2025, electric scooters could become costlier by Rs 45,000 compared with fiscal 2023 (~Rs 45,000 FAME subsidy and ~Rs 10,000 registration incentive, even as economies of scale afford a reduction in vehicle prices).

The TCA is also expected to increase by Rs 18,000-20,000 between fiscals 2023 and 2025, considering ~25% down-payment on the cost of vehicle (plus registration and insurance cost). This will make the TCA of electric scooters higher than that of ICE variants, which can potentially affect penetration, though this can be offset somewhat if electric two-wheeler makers share the benefits of PLI with customers.

The latest PLI scheme (aimed at enhancing India’s manufacturing capabilities for advanced products for five fiscals beginning 2023) for EVs and hydrogen fuel cell vehicles can restrict any steep increase in TCA and keep it around ICE variant levels.

So, as FAME II rides into the sunset, PLI could step in to support demand and subsequently push manufacturers to make investments in capacity building.

To cite an example, an electric scooter with an ex-showroom price of up to Rs 1.4 lakh (without FAME incentive) and on-road price of Rs 1.04 lakh (net of FAME incentive, and inclusive of registration, insurance and other miscellaneous costs) could realise incentives up to Rs 17,000 per vehicle over the period of the PLI scheme.

This is approximately 10-12% of the ex-showroom cost of the electric scooter. The vehicle maker could choose to partially or completely pass on the benefit to end customers, thereby limiting the increase in TCO and TCA. This will help sustain cost-competitiveness and encourage adoption of electric scooters post fiscal 2024.

TCA of scooter — electric vs ICE

As the chart above shows, after exhaustion of FAME II in fiscal 2023 and lower registration incentive in fiscal 2024, the TCA of electric scooters is expected be Rs 2,000-3,000 higher than that of ICE variants in fiscal 2025.

However, the differential could be reduced if vehicle makers pass on ~30% of the expected PLI benefit to customers.

Additionally, the TCA of electric scooters could be similar to ICE variants if ~75% of the expected PLI benefit is passed on to customers. In a scenario where ~100% of the PLI benefit is passed on to buyers, the TCA of electric scooters would be Rs 1,000 lower than that of ICE variants.

To sum up, the PLI scheme will enable manufacturers to sustain the price competitiveness of EVs versus ICE variants.

The motorcycle segment, too, would be eligible for the PLI benefit where, after the FAME II incentives get over, TCA is expected to increase by Rs 15,000 from fiscal 2023 to fiscal 2025. However, limited models and higher price will remain a deterrent versus electric scooters.

Overall, the PLI scheme is expected to push up adoption of electric scooters, given the availability of more models and significantly lower pricing. As such, vehicle makers will have enough incentive to invest in the manufacturing of electric scooters, which will boost supplies.

Given the favourable TCO and TCA, therefore, it makes sense to buy an electric scooter in the near term.

Similarly, for the three-wheeler segment, 10-12% of ex-showroom price of electric variants could be availed of under the PLI scheme. Here, too, TCA is expected to increase by Rs 10,000-15,000 from fiscals 2024 to 2025 after the FAME II incentives get over.

The TCA of electric three-wheelers will be higher than that of compressed natural gas (CNG) variants — after the FAME II incentive gets over — for the next 3-4 years. The PLI benefit could lower the TCA of electric variants comparable to CNG variants if fully passed on. That can tilt the needle firmly towards electric three-wheelers.

In passenger vehicles, the TCA of electric variants is expected to increase by Rs 75,000-80,000 and Rs 15,000- 20,000 for the personal and fleet segment, respectively, from fiscal 2023 to 2025 — and will remain higher compared with ICE variants till fiscal 2029.

A back-of-the-envelope calculation shows a similar 10-12% of ex-showroom price of electric variants could be availed of under the PLI scheme. If the PLI benefit is passed on fully to the customer, the TCA of passenger EVs could be lowered to an extent. That would support adoption by retail consumers.

Annexure

Key terms

- Incentive under the PLI scheme will be applicable from fiscal 2023, which will be disbursed in the subsequent year, i.e., fiscal 2024, and so on for a total of five consecutive years

- Base year: Fiscal 2020 will be treated as the base year for calculation of eligible sales value (not applicable for approved new non-automotive investor companies)

- Eligible sales value for vehicle segment: Total sales (net of Goods and Services Tax) for eligible vehicles

- Determined sales value (DSV) for vehicle segment: (Eligible sales value of vehicle segment for a particular year) – (Eligible sales value of vehicle segment for the base year)

- Pre-approved eligible product similar to the FAME scheme with minimum 50% domestic value addition will be eligible for incentive under this scheme

Scheme mechanism

- Approved applicants will be entitled to receive incentives (percentage benefit) on the DSV of advanced automotive technology components, subject to meeting other conditions of the scheme

- For an approved, new non-automotive investor company (that is currently not in the automobile or auto component manufacturing business), eligible sales value in the base year will be taken as zero

- Threshold DSV for the first year is Rs 125 crore for all companies, viz., existing automotive and new non- automotive investor companies under this component of the scheme to claim incentive

- On-year growth of minimum 10% in DSR for the first year, i.e., Rs 125 crore, has to be achieved by all approved companies, viz., existing automotive and new non-automotive investor companies, to become eligible to receive incentive

- Total incentive per group company(ies) is capped at Rs 6,485 crore (25% of total incentive outlay under this scheme)