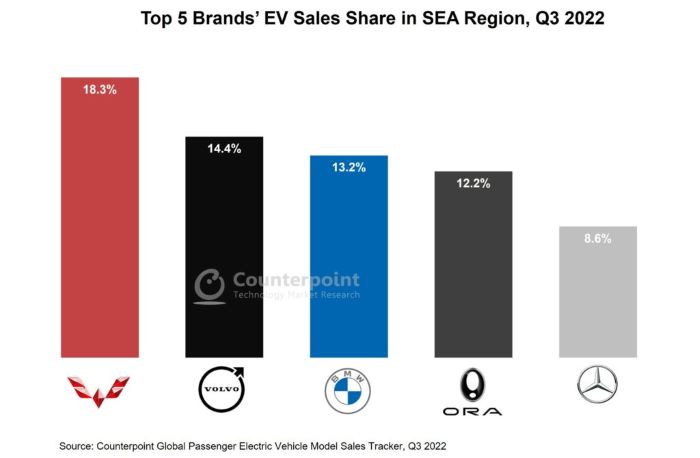

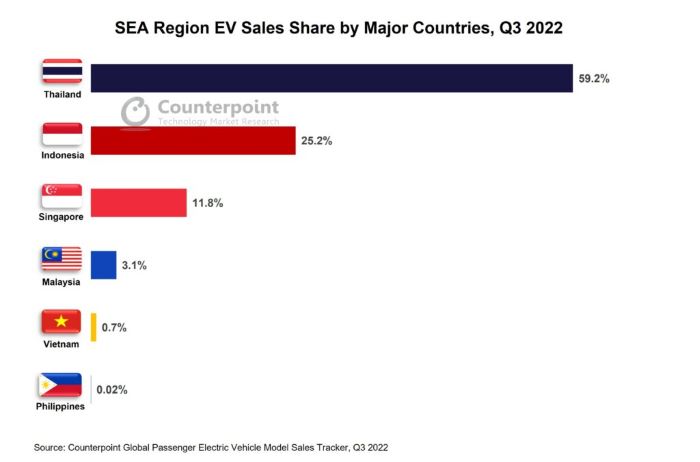

Passenger electric vehicle (EV*) sales** in Southeast Asia (SEA)# grew 35% YoY in Q3 2022, according to the latest research from Counterpoint’s Global Passenger Electric Vehicle Model Sales Tracker. Thailand registered the highest EV sales volume in the region, capturing almost 60% share, followed by Indonesia and Singapore. Battery EVs (BEVs) constituted 61% of the sales and plug-in hybrid EVs (PHEVs) the rest. The top five brands accounted for almost 67% of the EV sales in SEA. Wuling emerged as the best-selling EV brand followed by Volvo and BMW.

Commenting on the market dynamics, Research Analyst Abhilash Gupta said, “Although the passenger EV sales in SEA are small compared to other regions, the demand is gradually increasing. Currently, EV sales are just a tad over 2% of total passenger vehicle sales in the region. Many OEMs are setting up or are planning to set up manufacturing plants across the region due to favorable policies, subsidies and incentives by major SEA countries like Thailand, Indonesia, Singapore, and Malaysia.”

Market summary

Thailand’s EV market has grown tremendously this year, making it SEA’s undisputed EV leader. The country grabbed almost 60% of EV sales in SEA in Q3 2022. It aims to achieve 100% domestic sales from BEVs by 2035. Subsidies, excise duty waivers and import tax reductions have put Thailand on the right path in its EV journey.

Indonesia took 25% share in the SEA passenger EV market sales for Q3 2022. Also, during Q3, the country registered its highest EV sales volume till now. The Wuling Air EV model launched during this quarter became an instant hit here and was the best-selling EV model. Recently, many companies have announced plans for setting up EV battery production units in Indonesia, which is in line with the country’s target to build 140 GWh of battery capacity by 2030. Indonesia is a major player in vehicle production in SEA.

Singapore, another growing EV market, captured almost 12% share of the SEA EV sales. It has a target to achieve 100% zero-emission vehicle sales by 2030 and has introduced various incentives, policies and schemes to increase EV adoption. Alongside, it is also trying to develop a well-connected network of 60,000 charging points by the end of this decade.

Malaysia only had a 3% share in the SEA EV market in Q3 2022. Nonetheless, the Malaysian government is supporting the adoption of EVs and has exempted EVs from road, import, excise and sales taxes. Further push to develop charging infrastructure will boost EV sales.

Vietnam announced zero registration fee for EVs in March 2022. Vinfast, the major EV brand, recently discontinued its ICE models to focus on EVs. The future looks promising for the EV market to flourish in Vietnam.

Commenting on the market outlook, Senior Analyst Soumen Mandal said, “The SEA region’s automotive sector is mainly occupied by Japanese OEMs. However, with the shift in focus to EVs, they are facing stiff competition from the Chinese, South Korean and few local players. Affordability remains a major bottleneck for the region’s EV growth. But the scenario is changing with the availability of some cheaper EV options by Wuling, BYD, GWM and SAIC. Unlike developed EV markets such as the US and Europe, low-priced EV options are gaining popularity in emerging markets like Thailand and Indonesia. According to Counterpoint’s Global Passenger Vehicle Forecast, the SEA EV market is expected to grow at a fast pace and by the end of this decade EV sales are expected to cross the 3.5-million mark at a CAGR of 124%.”

*For EVs, we consider only BEVs and PHEVs. This study does not include hybrid EVs and fuel cell vehicles (FCVs).

**Sales refer to wholesale figures, i.e. deliveries from factories by the respective brands/companies.

#SEA here includes Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam.